The Whitewright Sun

Thursday, January 7, 1932

pg. 1

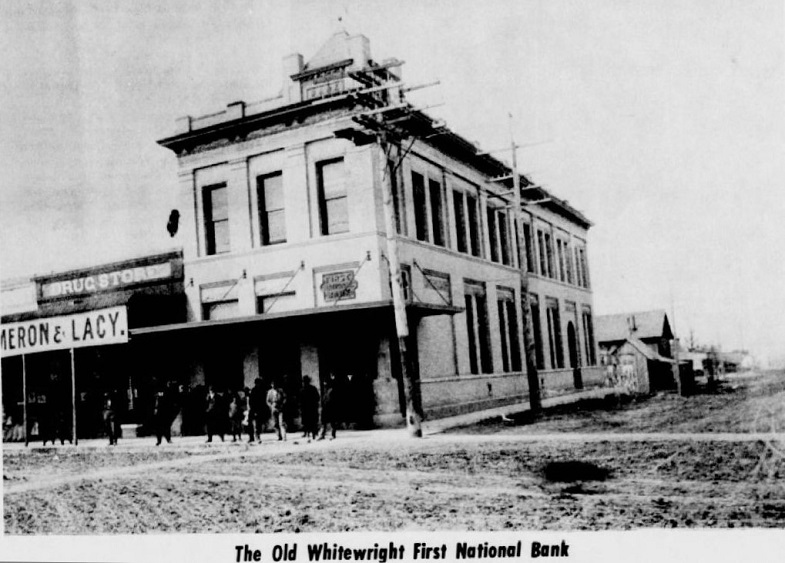

Whitewright Banks are Consolidated

For forty years Whitewright had two strong banking institutions, but on

December 31, 1931, they were merged and the merger gives Whitewright one of the

strongest banking institutions in this section of the state with total

resources of $939,701.01 and with over a half million dollars on deposit.

The Planters National Bank, which was established as a private bank in 1889 and

was nationalized in 1903, was merged with the First National Bank last

Thursday. The First National Bank was organized in 1892 with a

capital of $50,000.000. Since this time

the capital has been increased to $100,000.00 and a surplus fund of $100,000.00

built up. The $50,000.00 increase in

capital and the surplus fund were created from the earnings of the bank during

this period. In addition the bank has

paid an annual dividend with few exceptions since it was established forty

years ago. In the early history of the

bank earnings were placed in the surplus fund at stated times until the surplus

fund account equaled the capital.

During the forty-three years the Planters National Bank was in business it

built up a surplus fund of $20,000.000 and passed paying a dividend only a few

times. Up to the time of the merger

Whitewright was the only Northeast Texas town its size that boasted of two

strong banking institutions. The only

towns in this section of Texas that have two banks now are Greenville, Sherman,

Denison, McKinney, Bonham and Paris.

The First National Bank will continue under its $100,000 capital and

$100,000.00 surplus.

BOTH IN GOOD CONDITION

The business of both banks was in excellent condition when the merger was made

and the institutions were declared to be among the soundest in Texas. The merger was effected in order to eliminate

overhead expenses, which will enable the one institution to make a fair return

on its capital. Under present conditions

two banks with $100,000.00 capital each in a town the size of Whitewright were

not able to make a fair return on their capitals, but under the present plan,

with reduced expenses, one bank will be a paying institution and as sound as it

is possible for a bank to be. It is the

general opinion of business men and farmers generally that Whitewright bankers

used good judgment when they decided to consolidate the two banks.

Officers and directors of the First National Bank are all retained, with the

addition of Guy Hamilton, former president of the Planters National Bank, and

H.G. Webster, former cashier, as vice president and assistant cashier,

respectively. The officials of the bank

are: W.H. King, president; F.E. Douglas and Guy Hamilton, vice presidents; R.A.

Gillett, cashier; H.G. Webster, T.J. Lilley, C.B. Bryant Jr. and W.T. Simmons,

assistant cashiers; directors, C.B. Bryant, Sr., W.H. King, F.E. Douglas, T.E.

Sears, Kay Kimbell, Emmet Penn, J.B. King, R.T. Pennington and J.M. Wright.

The Whitewright Sun

Thursday, August 12, 1971

pg. 6

FIRST NATIONAL HAS HAD THREE PRESIDENTS

The First National Bank has had three presidents since it was organized forty

years ago, Dr. D.M. Ray, deceased; C.B. Bryant, Sr., and W.H. King. Guy Hamilton, who was president of the

Planters National Bank, was connected with that institution for over thirty

years. He was made president following

the death of the late Senator D.S. McMillin, who was president of the bank for

a number of years. Mr. Webster started

his banking career with the Planters National Bank some twelve years ago and

gradually worked his way up to the cashiership.

The statement of the First National Bank appears on another page in this issue

of The Sun. Turn to it and read it. This statement will convince anyone that

Whitewright has a strong banking institution.

It has in cash and quick cash asssets $471,080.23 with deposits totaling

$536,082.09. These two items show that

the First National Bank is in position to pay every depositor his money on

short notice, if it became necessary.

This is a condition that attracts the attention of bankers over the

state and elsewhere. The people of

Whitewright and section have known all the time that their money was safe in

Whitewright banks, and now they have more reason to feel secure since the banks

have merged.

PAY DIVIDEND

On December 31st the First National Bank mailed dividend checks to

its stockholders. The checks represented

a six per cent dividend on the capital stock, which is $100,000.00.